How a Financial Dashboard Can Revolutionize Your Personal Finances

In today’s fast-paced and data-driven world, managing personal finances can be a daunting task. However, with the advent of financial dashboards, individuals now have a powerful tool at their disposal to revolutionize the way they handle their money. A financial dashboard is a digital platform that provides an overview of an individual’s financial health, offering real-time data visualization, goal tracking, and expense analysis. In this article, we will explore how a financial dashboard can transform the way you manage your personal finances and help you achieve your financial goals.

1. Introduction

Managing personal finances efficiently is essential for a secure and stable future. However, it can be challenging to keep track of multiple accounts, investments, and expenses. This is where a financial dashboard comes in, streamlining the process and providing valuable insights to make informed financial decisions.

2. Understanding Financial Dashboards

2.1 What is a financial dashboard?

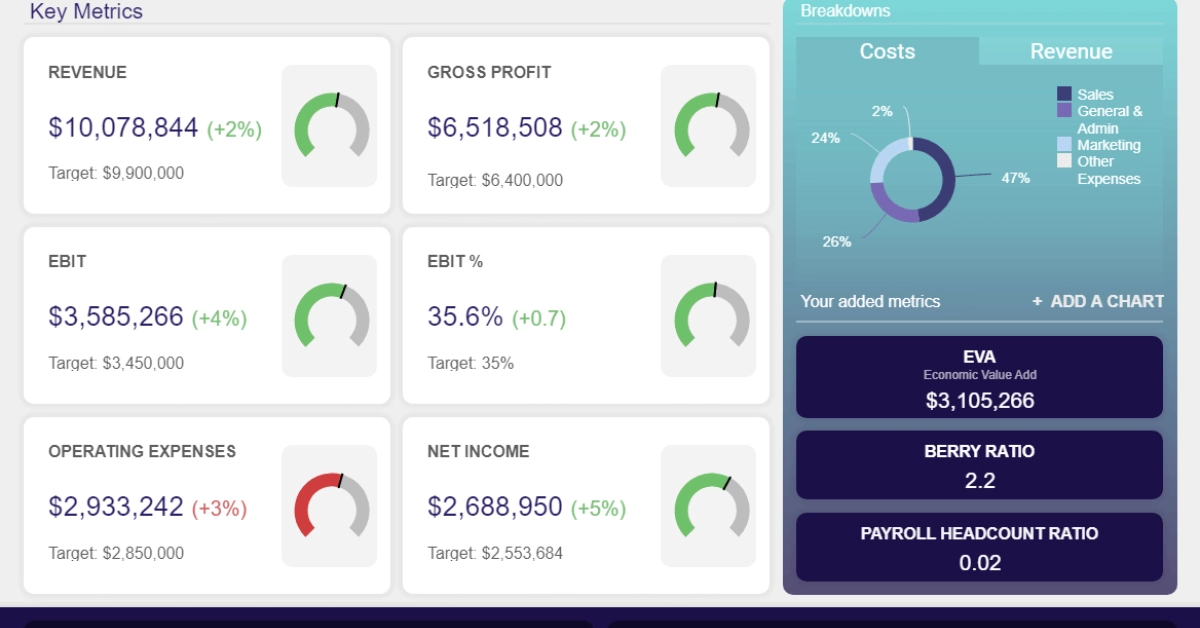

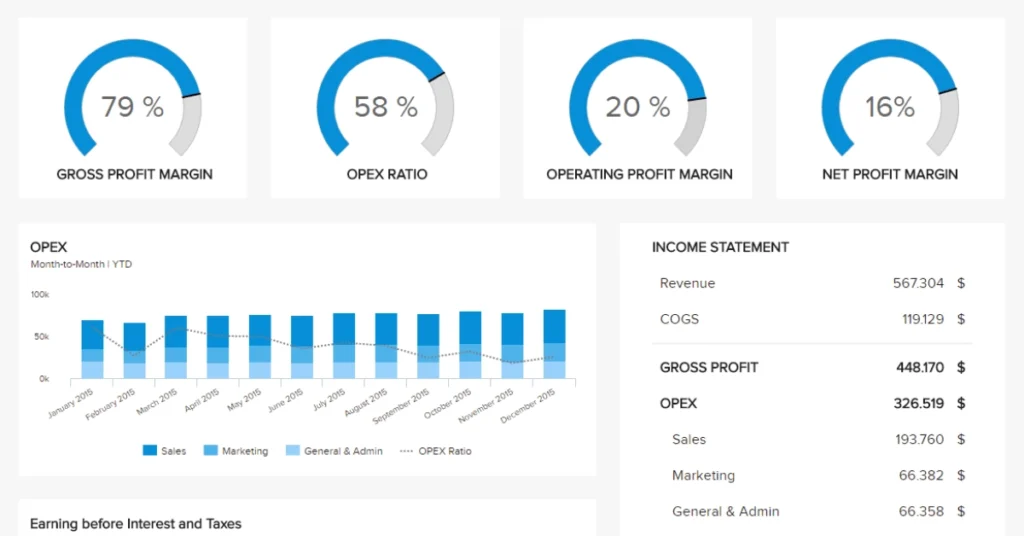

A financial dashboard is a digital tool that consolidates all your financial data into one centralized platform. It presents a visual representation of your financial health, displaying key metrics, charts, and graphs that provide a comprehensive overview of your income, expenses, savings, and investments.

2.2 Benefits of using a financial dashboard

Financial dashboards offer numerous benefits, including:

- Better financial visibility: A financial dashboard provides a holistic view of your financial situation, allowing you to see the big picture and make informed decisions.

- Real-time data analysis: With real-time data integration, financial dashboards offer up-to-date insights into your finances, helping you identify trends and make timely adjustments.

- Goal tracking and progress monitoring: Financial dashboards enable you to set financial goals and track your progress towards achieving them, providing motivation and accountability.

- Expense and income analysis: By categorizing and analyzing your expenses and income, financial dashboards help you identify areas for improvement and make adjustments to your spending habits.

3. Key Features of a Financial Dashboard

To fully revolutionize personal finances, a financial dashboard should possess the following key features:

3.1 Real-time data visualization

A financial dashboard should provide real-time data visualization, allowing you to see the current state of your finances at a glance. This feature ensures that you have access to the most up-to-date information for making informed decisions.

3.2 Customizable widgets and metrics

Every individual has unique financial goals and

preferences. A robust financial dashboard allows you to customize widgets and metrics according to your specific needs. Whether you want to track your monthly budget, analyze investment performance, or monitor debt repayment progress, the ability to personalize the dashboard empowers you to focus on what matters most to you.

3.3 Goal tracking and progress monitoring

Setting financial goals is crucial for achieving long-term financial success. A financial dashboard should include features that allow you to set goals, such as saving for a down payment on a house or paying off credit card debt. It should also provide visual representations of your progress towards these goals, helping you stay motivated and on track.

3.4 Expense and income analysis

Understanding where your money is coming from and where it’s going is fundamental to effective financial management. A comprehensive financial dashboard offers detailed expense and income analysis, categorizing your transactions and providing insights into your spending patterns. This analysis helps you identify areas where you can reduce expenses and increase savings.

4. How to Create a Personal Financial Dashboard

Now that you understand the benefits and key features of a financial dashboard, let’s explore how you can create one for your personal finances.

4.1 Choosing the right tools and software

Start by selecting a financial dashboard tool or software that aligns with your needs. Consider factors such as ease of use, compatibility with your devices, integration capabilities with your financial accounts, and security measures.

4.2 Identifying key financial metrics

Determine the key financial metrics that are important to you. This may include tracking your net worth, monthly expenses, savings rate, investment returns, or debt-to-income ratio. By identifying these metrics, you can ensure that your dashboard provides the most relevant information for your financial goals.

4.3 Designing the dashboard layout

A well-designed dashboard layout enhances user experience and ensures easy navigation. Organize your widgets and metrics in a logical manner, prioritizing the most important information. Consider using visual elements such as charts and graphs to make data more easily digestible.

4.4 Connecting and integrating data sources

To populate your financial dashboard with data, connect it to your various financial accounts such as bank accounts, credit cards, investment portfolios, and loan accounts. Integration allows for automatic data synchronization, saving you time and effort in manual data entry.

5. Analyzing and Leveraging Insights

Once your financial dashboard is set up, it’s time to analyze the insights it provides and leverage them to improve your financial situation.

5.1 Monitoring spending habits

Use your financial dashboard to track your spending habits and identify areas where you can cut back or optimize expenses. Visual representations of your spending categories can highlight areas of overspending and guide you towards better budgeting decisions.

5.2 Identifying saving opportunities

A financial dashboard can help you identify opportunities to save money. By monitoring your income, expenses, and savings rate, you can pinpoint areas where you can increase savings and optimize your financial goals.

5.3 Tracking investment performance

If you have investments, your financial dashboard can provide a snapshot of their performance. Monitor returns, compare them to benchmarks, and adjust your investment strategy accordingly. Visualizing investment performance can also provide peace of mind during market fluctuations.

5.4 Setting and achieving financial goals

Utilize the goal tracking features of your financial dashboard to set specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. Regularly review your progress and make adjustments as necessary. The visual representation of your goals can serve as a constant reminder of what you’re working towards.

6. Security and Privacy Considerations

When using a financial dashboard, it’s essential to prioritize security and privacy. Choose a reputable platform that implements strong encryption and data

protection measures. Ensure that your financial data is encrypted both during transmission and storage. Additionally, review the platform’s privacy policy to understand how your data will be used and shared.

It’s advisable to use strong, unique passwords for your financial dashboard accounts and enable two-factor authentication for an added layer of security. Regularly update your passwords and keep your software and devices up to date with the latest security patches.

7. Examples of Financial Dashboard Software

There are several financial dashboard software options available in the market. Here are a few examples:

- Mint: Mint is a popular personal finance management tool that offers a comprehensive financial dashboard, budgeting features, and expense tracking.

- Personal Capital: Personal Capital provides a robust financial dashboard along with investment tracking and retirement planning tools.

- YNAB (You Need a Budget): YNAB is a budgeting app that offers a clean and intuitive financial dashboard to help you track and manage your expenses.

- Quicken: Quicken is a long-standing personal finance software that provides a wide range of features, including a customizable financial dashboard.

It’s important to research and compare different options to find the financial dashboard software that best suits your needs and preferences.

8. Conclusion

In conclusion, a financial dashboard can revolutionize your personal finances by providing a centralized platform for monitoring, analyzing, and managing your financial health. With real-time data visualization, customizable metrics, and goal tracking features, a financial dashboard empowers you to make informed decisions, optimize your spending, and work towards your financial goals. By leveraging the insights and tools provided by a financial dashboard, you can take control of your personal finances and pave the way for a secure and prosperous future.