Data-Driven Decision Making: Empowering Your Finances with Advanced Dashboard Insights

Introduction

In today’s data-rich world, organizations have access to vast amounts of information. However, without proper analysis and utilization, this data remains untapped potential. This is where data-driven decision making comes into play. By leveraging advanced dashboard insights, businesses can gain a competitive edge, make informed financial decisions, and drive growth. In this article, we will explore the power of data-driven decision making and how it can empower your finances.

1. Definition of Data-Driven Decision Making

Data-driven decision making is an approach that involves using data and analytics to guide business decisions. It goes beyond relying on gut feelings or intuition and emphasizes the importance of objective analysis. By collecting, analyzing, and interpreting relevant data, organizations can make informed choices that are backed by evidence and insights. This enables them to stay ahead of the curve and make strategic financial decisions with confidence.

2. Benefits of Data-Driven Decision Making

Implementing data-driven decision making can bring several benefits to your organization, especially in the realm of finance.

a) Enhanced Financial Insights

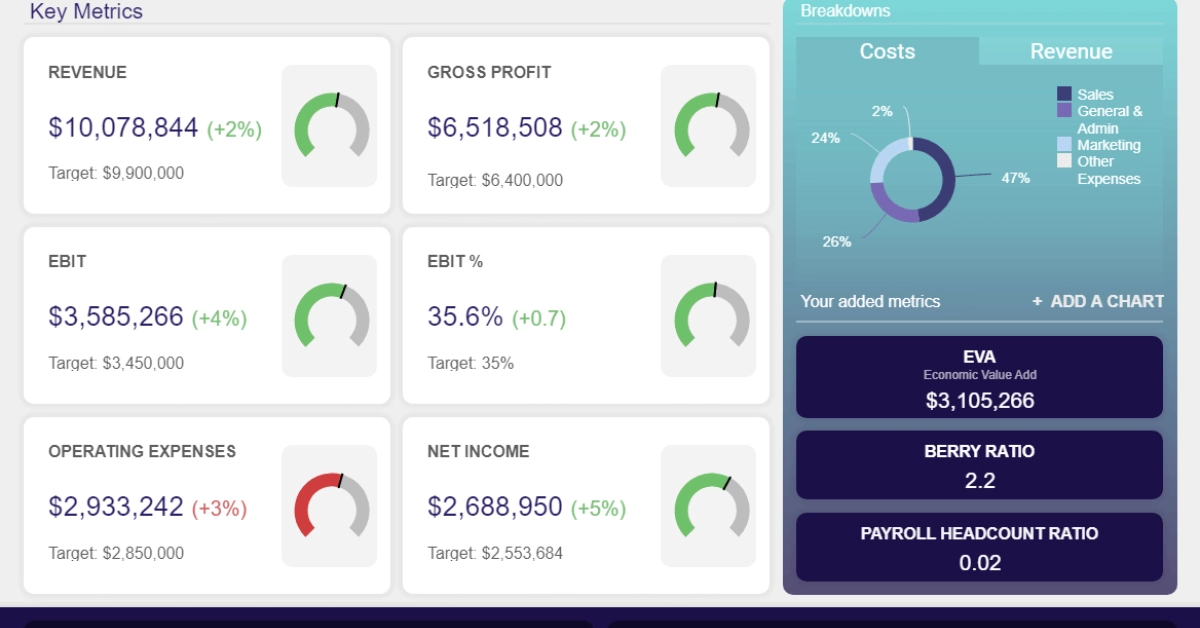

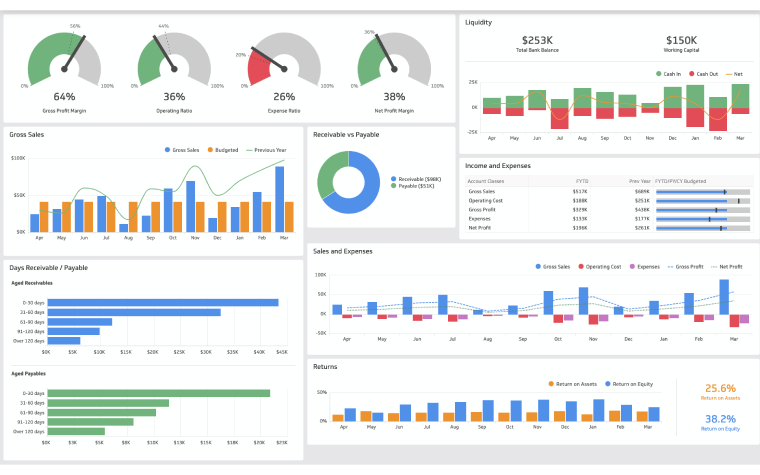

By harnessing the power of data, businesses can gain a deeper understanding of their financial performance. Advanced dashboards provide visual representations of key metrics, such as revenue, expenses, and profitability, allowing for quick and comprehensive analysis. These insights enable businesses to identify areas of improvement, make data-backed forecasts, and optimize financial strategies.

b) Improved Accuracy and Efficiency

Data-driven decision making reduces the reliance on manual processes and guesswork. With accurate and reliable data at their fingertips, finance teams can automate repetitive tasks, streamline workflows, and minimize human errors. This leads to improved efficiency, time savings, and more reliable financial reporting.

c) Identification of Trends and Patterns

Data-driven decision making enables organizations to uncover hidden trends and patterns within their financial data. By analyzing historical and real-time data, businesses can identify emerging market trends, customer preferences, and other factors that impact financial performance. This knowledge empowers businesses to make proactive decisions, adapt to changing market conditions, and seize new opportunities.

d) Effective Risk Management

Financial decisions inherently involve risks. However, data-driven decision making equips businesses with the tools to manage and mitigate risks effectively. Advanced dashboards provide real-time visibility into risk indicators, enabling proactive risk assessment and mitigation strategies. By identifying potential risks early on, businesses can take preventive measures and minimize potential financial losses.

e) Increased Profitability

At the heart of every financial decision lies the goal of increasing profitability. Data-driven decision making allows businesses to optimize revenue generation and cost management strategies. By analyzing financial data and identifying profit drivers, businesses can allocate resources more effectively, optimize pricing strategies, and identify areas for cost savings. This leads to increased profitability and long-term financial success.

3. Components of an Advanced Dashboard

To harness the full potential of data-driven decision making, organizations need an advanced dashboard that can provide actionable insights. Here are the key components of an advanced dashboard:

a) Data Collection and Storage

An advanced dashboard relies on the collection and storage of relevant data. It integrates data from multiple sources, such as financial systems, customer databases, and market research platforms. The data is stored securely in a centralized database, ensuring accessibility and data integrity.

b) Data Visualization and Analysis

The power of data lies in its visualization and analysis. Advanced dashboards employ visual representations, such as charts, graphs, and heatmaps, to make complex financial data more understandable and actionable. These visualizations enable finance teams to identify trends, patterns, and outliers at a glance, facilitating better decision making.

c) Integration of Multiple Data Sources

To gain comprehensive insights, an advanced dashboard integrates data from various sources. This includes financial data, sales data, customer data, and external data sources, such as economic indicators or industry benchmarks. By combining different datasets, businesses can gain a holistic view of their financial performance and make data-driven decisions across different functions.

d) Real-Time Tracking and Reporting

An advanced dashboard provides real-time tracking and reporting capabilities. It ensures that finance teams have access to the most up-to-date information, allowing them to monitor key metrics and performance indicators in real-time. This enables proactive decision making and timely interventions when needed.

4. Challenges in Implementing Data-Driven Decision Making

While data-driven decision making offers numerous benefits, there are challenges that organizations may face during implementation.

a) Data Quality and Integrity

The quality and integrity of data are crucial for accurate decision making. Organizations need to ensure that the data they collect is reliable, complete, and free from errors. This involves establishing data governance processes, implementing data validation checks, and maintaining data hygiene practices.

b) Lack of Skilled Resources

Data-driven decision making requires a skilled workforce that can collect, analyze, and interpret data effectively. Many organizations face a shortage of data scientists, analysts, and other professionals with the necessary expertise. To overcome this challenge, organizations can invest in training and upskilling programs or collaborate with external partners to bridge the skills gap.

c) Overcoming Resistance to Change

Implementing data-driven decision making often involves a cultural shift within an organization. Some employees may be resistant to change or skeptical about the benefits of data-driven approaches. It is crucial to address these concerns through effective communication, training, and showcasing success stories to gain buy-in from stakeholders at all levels.

5. Best Practices for Implementing Data-Driven Decision Making

To successfully implement data-driven decision making and leverage advanced dashboard insights, organizations can follow these best practices:

a) Setting Clear Goals and Objectives

Clearly define the goals and objectives of data-driven decision making initiatives. Align these goals with the overall business strategy and communicate them across the organization. This clarity ensures that data collection and analysis efforts are focused and tied to specific outcomes.

b) Collecting Relevant and Reliable Data

Identify the key data sources that are relevant to your financial decision making. Ensure the quality and reliability of the data by implementing robust data collection processes and validation mechanisms. Consider both internal and external data sources to gain a comprehensive understanding of the factors influencing financial performance.

c) Ensuring Data Security and Privacy

Data security and privacy are of paramount importance when working with sensitive financial information. Implement robust data security measures, such as encryption, access controls, and regular data backups. Comply with relevant data protection regulations, such as GDPR or CCPA, to protect customer and financial data.

d) Training and Upskilling Employees

Invest in training and upskilling programs to equip employees with the necessary data literacy skills. Provide training on data analysis tools, data visualization techniques, and interpretation of financial insights. This empowers employees at all levels to make data-driven decisions and fosters a culture of continuous learning.

e) Continuous Monitoring and Optimization

Data-driven decision making is an ongoing process. Continuously monitor key financial metrics and track the performance of your data-driven initiatives. Regularly assess the effectiveness of your advanced dashboard and make adjustments based on feedback and changing business needs. Optimization ensures that your data-driven decision making approach remains relevant and aligned with your business goals.

Conclusion

Data-driven decision making is a powerful tool that empowers organizations to make informed financial decisions, drive growth, and stay ahead of the competition. By leveraging advanced dashboard insights, businesses can gain enhanced financial insights, improve accuracy and efficiency, identify trends and patterns, manage risks effectively, and increase profitability. While challenges may arise during implementation, following best practices and fostering a data-driven culture can pave the way for success in the era of data-driven decision making.